March 28 2019 Also known as the balance sheet equation the accounting equation formula is Assets Liabilities Equity. The equation best describing the balance sheet Assets Liabilites Stockholders Equity At the end of the current period Maltese Inc.

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Assets Liabilities Stockholders Equity In what are financial statements prepared.

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

. Revenues - Expenses Net Income. The balance sheet equation tells us that assets always has to equal liabilities plus owners equity or the funds the company has obtained always has to be equal to the resources in which it has invested. The purpose of the balance sheet is to reveal the financial status of a business as of a specific point in time.

Sometimes youll see the term net assets or net worth to describe the shareholders equity account as well. 1 balance sheet 2 income statement and 3 statement of stockholders equity. Assets go on one side liabilities plus equity go on the other.

You pay for your companys assets by either borrowing money ie. Multiple Choice Assets Liabilities Stockholders Equity. Factors on a Balance Sheet.

The body of rules and procedures that guide the measurement and communication of financial accounting information in the United States is known as. Primary purpose of financial accounting- both measure and communicate financial information to external parties. The accounting formula is.

Sometimes its so important that we might even call it the accounting equation. In 2019 it recorded 157 billionthey acquired 17 billion in assets over that period. Assets Liabilities Stockholders Equity.

Revenues and gains cause owners or stockholders equity to increase. Just like the accounting equation it shows us that total assets equal total liabilities and owners equity. This information is more valuable when the balance sheets.

Ending Retained Earnings Dividends Net Income. Reports the following amounts. Assets Equity - Liabilities.

LVMH replaces the label share- holders equity with just equity What might explain this difference in labeling of this section of the consolidated balance sheet. The basic accounting equation In the basic accounting equation liabilities and equity equal the total amount of assets. Assets Liabilities Shareholders Equity This equation sets the foundation of double-entry accounting and highlights the structure of the balance sheet.

So now we can see that the balance sheet equation says which is Total assets Total Liabilities Total equitys shareholders and in this case it is 183500. Ending Retained Earnings Dividends Net Income. The purpose of the balance sheet.

The equation best describing the balance sheet is. Equation best describing the balance sheet is- Assets Liabilities Stockholders Equity. The equation best describing the balance sheet is.

Par Value of common stock- legal capital par share of stock assigned when the corporation was first established. The balance sheet is a more detailed reflection of the accounting equation. The equation is as follows.

By combining the two an investor can get a clear picture of a companys financial strength. The equation best describing the balance sheet is. B Revenues - Expenses Net Income.

Revenues - Expenses Net Income. Increasing your liabilities or getting money from the owners equity. Stockholders Equity Assets - Liabilities.

The two sides must balancehence the name balance sheet. How are these basics used in the balance sheet equation. Now another way to say the balance sheet equation rather than assets equals liabilities plus owners equity is to say that owners equity or shareholders equity is assets minus liabilities.

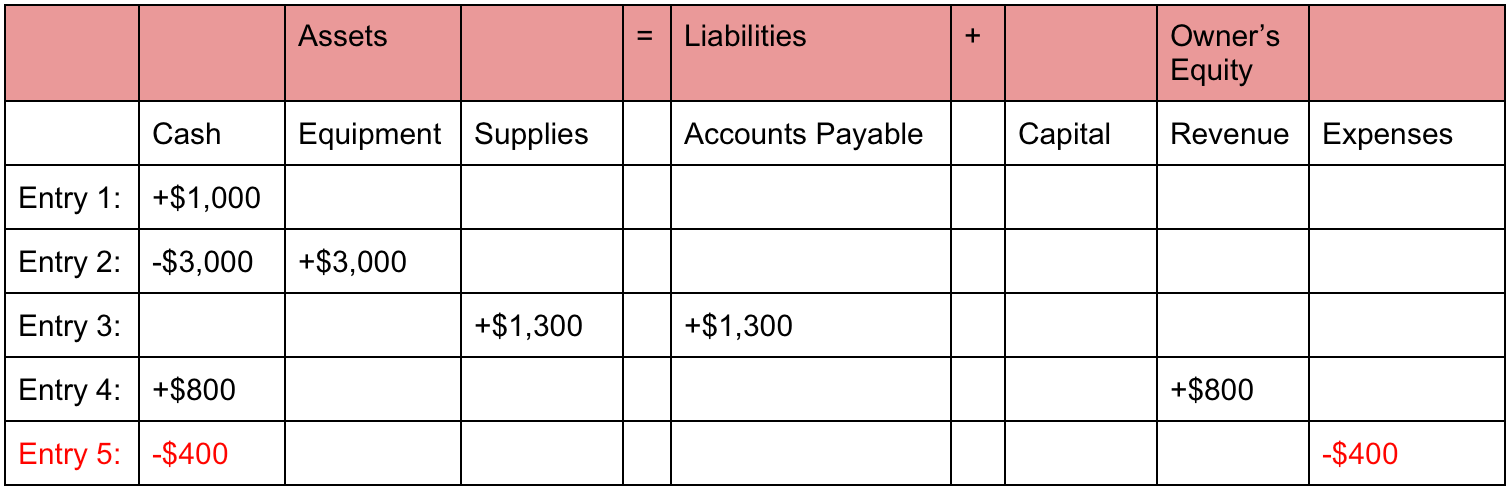

It records the assets liabilities and owners equity of a business at a specific time. This equation should be supported by the information on a companys balance sheet. Double-entry accounting is a system where every transaction affects both sides of.

If youre using formulas to calculate financial ratios you may see terms in the equations not listed on the balance sheet. Assets Liabilities Owners Equity. But well stick with the balance sheet equation for now.

Basically the income statement components have the following effects on owners equity. For instance Johnson Johnsons balance sheet for December 31 2020 lists 174 billion in assets. Total Assets 183500.

A Assets Liabilities Stockholders Equity. C Ending Retained Earnings Dividends Net Income. Total Assets Liabilities Owners Equity Where Liabilities It is a claim on the asset of the company by other firms banks or people.

Assets Liabilities Stockholders Equity. However balance sheets measure the actual net worth of a company based on assets. Income statements measure the profitability of a company based on income.

A balance sheet describes the formula. The accounting equation Assets Liabilities Owners Equity. The equation best describing the balance sheet is a Assets Liabilities Course Hero The equation best describing the balance sheet is a 5.

Expenses and losses cause owners or. The equation best describing the balance sheet is. The balance sheet adheres to the following accounting equation with assets on one side and liabilities plus shareholder equity on the.

The equation that best describes the balance sheet is. Assets Liabilities Equity Because you make purchases with debt or capital both sides of the equation must equal. Revenues Expenses Net Income.

The statement shows what an entity owns assets and how much it owes liabilities as well as the amount invested in the business equity. Total Assets 25000 25000 83500 30000 20000. The balance sheet formula state that the sum of liabilities and owners equity is equal to a total asset of the company.

GAAP the balance sheet equation is defined as ALSE.

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

0 Comments